Optimal Solutions for Facebook Ad Payments: What to Choose

When selecting cards for ad payments, most people focus on fees and limits. Sure, that’s important, but in media buying, something matters even more: getting payments approved. If a payment fails, the entire campaign’s goals can go unmet. Meta takes a strict approach to payments. Not every card is fit for covering Facebook ads. The […] The post Optimal Solutions for Facebook Ad Payments: What to Choose appeared first on Entrepreneurship Life.

When selecting cards for ad payments, most people focus on fees and limits. Sure, that’s important, but in media buying, something matters even more: getting payments approved. If a payment fails, the entire campaign’s goals can go unmet.

Meta takes a strict approach to payments. Not every card is fit for covering Facebook ads. The best solutions for ad payments on Facebook are virtual cards with BINs (Bank Identification Numbers) from banks in the UK, the US, or Europe. The cards should work with Visa and Mastercard and support payments in either dollars or euros. Plus, the card balance should be sufficient to cover the transaction. If these conditions aren’t met, Facebook may reject the payment or even block your ad account.

Now, here’s a detailed review of five virtual cards that can help reduce declines when paying for Facebook ads.

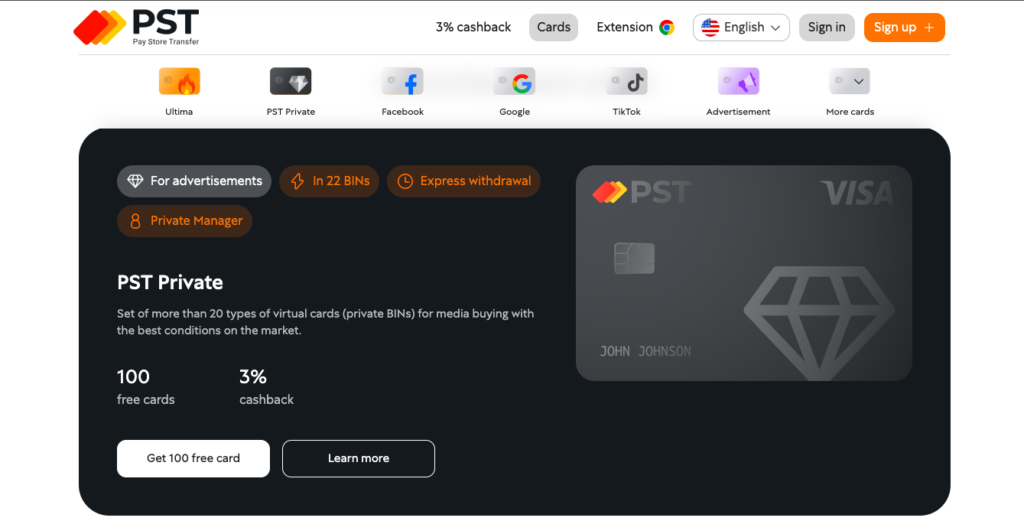

1. PSTNET

PSTNET issues virtual cards specifically tailored for popular advertising platforms, including dedicated options for Facebook Ads. For Facebook payments, you can choose either a dedicated card for Facebook Ads or a PST Private card. These cards are compatible with Visa and Mastercard, and both debit and credit cards are available in unlimited quantities. The biggest advantage? No transaction fees, no withdrawal fees, and no charges for blocked transactions.

PSTNET cards are issued by banks in Europe and the US, with over 25 trusted BINs that reduce the chances of declined payments. All cards come with 3D Secure and two-factor authentication.

Additional Features:

- Media buyer benefits: 3% cashback on ad spending, up to 100 free cards per month

- Special tools: free BIN checker

- Funding methods: supports 18 cryptocurrencies (BTC, USDT TRC20, ERC20, etc.), SWIFT/SEPA bank transfers, and other Visa/Mastercard cards

- Team collaboration tools: assign tasks, set user roles, and set card limits — a helpful feature for media buying teams managing multiple projects

- Telegram bot: receive 3D Secure codes and service updates

- One-minute registration: sign up using Apple ID, Google, Telegram, WhatsApp, or email

- 24/7 support: instant support via Telegram, WhatsApp, or live chat

2. Flexcards

Flexcards issues Visa and Mastercard virtual cards for ad payments. These debit cards are available in unlimited quantities and support transactions in euros.

Advantages include zero fees on card maintenance, declines, and transactions. The cards are issued by banks in the US and Europe, and users can choose from three trusted BINs, updated every three to four months.

Additional Features:

- Funding methods: USDT TRC20, bank transfers, Capitalist platform, and partner balance transfers

- Team collaboration tools: assign tasks, set user roles, and card limits

- Expense analytics: financial operation reports available for users

- Registration: a two-hour setup that requires completing a form and approval from a manager

- Support hours: 10:00 to 22:00 (GMT +3)

3. Lamanche Payments

Lamanche Payments caters to media buyers with its virtual card issuing and management services. All cards are debit and compatible with Visa, Mastercard, and UnionPay. The top-up fee varies by funding method, and there are limits on card issuance — a maximum of 10 cards per day, with a total cap of 30.

The service uses eight BINs from UK banks, which helps reduce payment declines.

Additional Features:

- Funding methods: USDT TRC20, ERC20 through JackWallet crypto wallet

- Team collaboration tools: add users and assign roles

- Expense analytics: transaction reports available in the personal account

- Notifications and 3DS codes: available in the personal account

- Registration: requires up to 24 hours through a personal manager, with a brief form to complete

- 24/7 support: responsive on Telegram

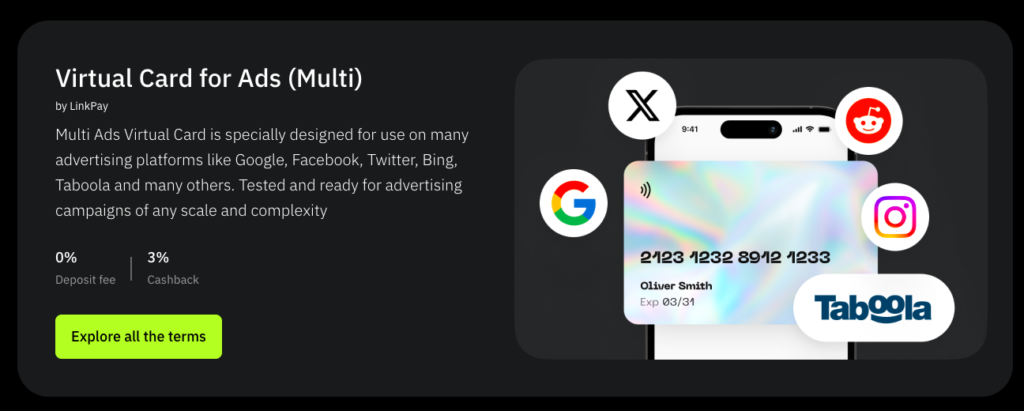

4. LinkPay

LinkPay offers virtual cards for various needs, including a Multi Ads card specifically designed for payments on major platforms. This Visa/Mastercard credit card comes with zero fees for top-ups, withdrawals, and declines. Payments are managed through a service subscription.

The cards are issued by banks in Europe and the CIS, and there are five types of BINs available.

Additional Features:

- Special offers: 100 free virtual cards with enhanced rates and cashback on the Plus plan

- Funding methods: seven cryptocurrencies, bank transfers, and other Visa/Mastercard cards

- Team collaboration tools: task assignment, user roles, and card limits

- Real-time expense analytics: accessible via the personal account

- Notifications and 3DS codes: available in the personal account and via Telegram

- Registration: takes under 24 hours with a standard online form, no KYC needed

- 24/7 support: via website chat and Telegram

5. Capitalist

Capitalist is a popular platform for online financial transactions, offering virtual media-buying cards — Cards Pro. These Visa/Mastercard-supported cards handle payments in dollars and euros and can be issued in unlimited numbers.

Decline fees are capped at $0.30, with no transaction fees.

The cards are issued by banks in the UK, the US, and Europe, with nine BINs available.

Additional Features:

- Special offers: tailored solutions for large clients

- Funding methods: five cryptocurrencies, international SWIFT/SEPA transfers, and other Visa/Mastercard cards

- Team collaboration tools: task management, sub-account setup, and card limits

- Expense analytics: financial transaction reports

- Notifications and 3DS codes: available in the personal account and via Telegram

- Registration: under 24 hours via standard online form, email verification, request for Cards Pro issuance in the personal account, brief activity survey, and a short interview with a service manager

- 24/7 support: accessible on Telegram

Conclusion

Declines can jeopardise the success of an entire ad campaign. Meta carefully monitors payment methods, and using an incompatible card can result in payment rejections or even account bans. The virtual cards in our ranking are tailored to avoid such issues.

PSTNET, Flexcards, Lamanche Payments, LinkPay, and Capitalist meet Facebook’s main requirements. They support payments in dollars and euros and offer trusted BINs from reliable banks in Europe and the US, with regular updates.

PSTNET stands out with its attractive offer through the PST Private programme, featuring a 3% cashback and 100 free cards, plus a BIN checker. LinkPay and CardsPro (from Capitalist) also offer special terms for media buyers, while Flexcards and Lamanche Payments provide consistently positive features and regularly updated BINs.

Using verified cards from our ranking not only simplifies working with Facebook Ads but also increases the likelihood of successful payments, helping achieve campaign goals and keep within Meta’s guidelines.

The post Optimal Solutions for Facebook Ad Payments: What to Choose appeared first on Entrepreneurship Life.

What's Your Reaction?

:quality(85):upscale()/2025/02/27/808/n/1922398/26784cf967c0adcd4c0950.54527747_.jpg)

:quality(85):upscale()/2025/02/03/788/n/1922283/010b439467a1031f886f32.95387981_.jpg)

:quality(85):upscale()/2025/01/08/844/n/1922398/cde2aeac677eceef03f2d1.00424146_.jpg)

:quality(85):upscale()/2024/11/27/891/n/1922398/123acea767477facdac4d4.08554212_.jpg)